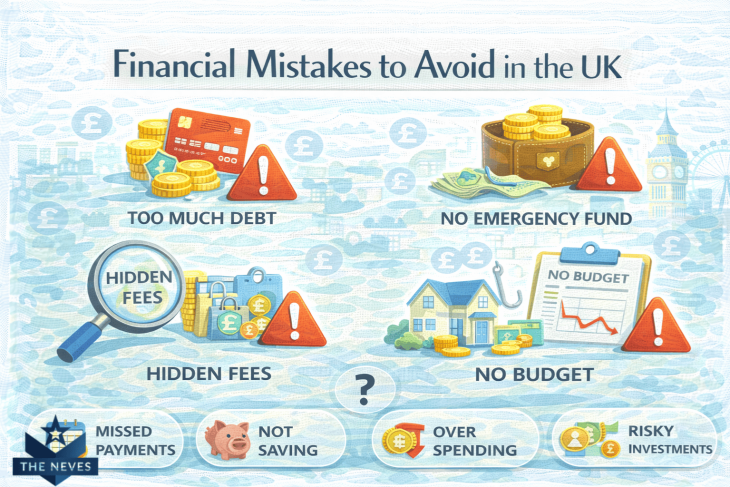

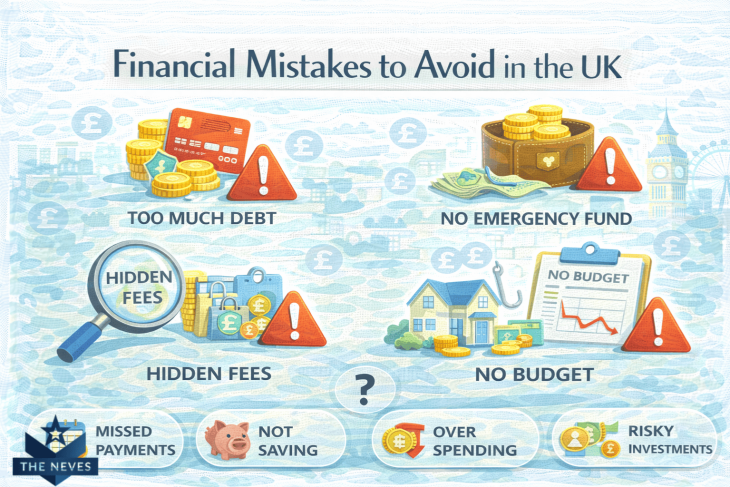

Financial Mistakes to Avoid in the UK

financial mistakes UK can derail your goals—learn common traps, quick fixes and smarter choices to protect savings and credit.

Here, we gather content designed to strengthen financial awareness and autonomy. From personal finance fundamentals to smarter money management strategies, this section aims to clarify complex concepts in a direct and accessible way. What often seems confusing or overwhelming becomes practical knowledge you can actually use.

financial mistakes UK can derail your goals—learn common traps, quick fixes and smarter choices to protect savings and credit.

financial planning UK helps you balance immediate needs and future goals, with practical steps for budgeting, saving, and retirement planning.

financial scams UK: Learn to spot common frauds, protect your money and act fast with clear, practical steps anyone can use.

personal loans UK help you consolidate debt, compare rates and plan repayments—practical tips and real examples to guide your next move.

mortgages for first time buyers UK: clear, practical guidance on deposits, interest rates, and eligibility to help you secure your first home.

manage monthly expenses UK: simple, practical strategies to cut bills, track spending and build a realistic budget that fits your life.

how credit scores work UK: Learn what influences your score, how lenders use it, and simple steps to improve your chances of approval.

APR meaning UK; understand how annual percentage rate affects loans, credit cards and mortgages so you can compare offers and save money.

how to reduce debt UK: practical steps to cut repayments, negotiate with creditors, and regain financial control in months.

loans vs credit cards UK: Compare costs, flexibility and risks to pick smarter borrowing—practical tips and examples for UK borrowers.

saving money tips UK: discover top budgeting apps that help you track spending, set goals and save more without stress.

saving money tips UK: practical, everyday strategies to cut bills, shop smarter and boost savings—simple steps you can try this month.

build credit score UK: practical steps to improve your credit profile, from checking reports to smart borrowing and fixing errors.

personal finance basics UK: practical tips to manage budgets, debts, savings and pensions—simple steps for everyday financial confidence.