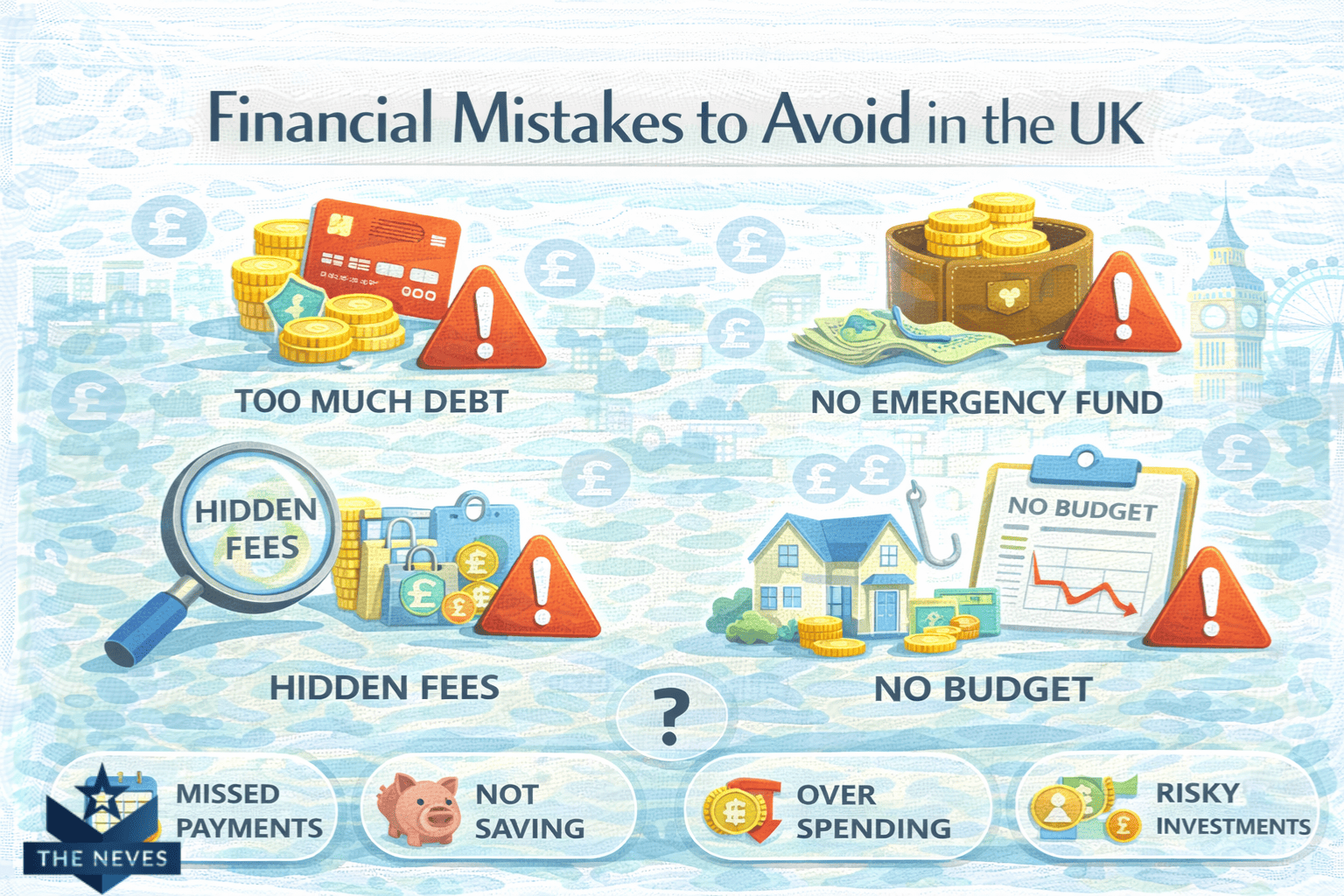

Financial Mistakes to Avoid in the UK

financial mistakes UK can derail your goals—learn common traps, quick fixes and smarter choices to protect savings and credit.

financial mistakes UK can sneak up fast—missing pension contributions or mishandling credit often costs more than we expect. Want clear, practical fixes you can apply this month? Keep reading for tips that actually help.

Common budgeting errors that quietly drain your money

Small mistakes in a budget can quietly chip away at your money. Skipping to record spending, ignoring annual bills or relying on credit are common traps. Fixes are simple and practical, and they often save more than you expect.

Track every expense, even the tiny ones

Record purchases daily for a month to see where cash really goes. Use a simple app or a notebook. Small items add up: a £3 coffee five times a week becomes about £60 a month. Group similar costs so you spot patterns fast.

- Set a one-week challenge to log every spend.

- Review your bank app weekly to catch surprises.

- Create categories: groceries, transport, subscriptions, extras.

Include irregular and annual costs

Many assume bills are monthly, but car tax, MOT, annual insurance and household repairs arrive less often. Divide each annual cost by 12 and add that amount to your monthly budget so these items don’t cause shortfalls.

For example, if a yearly policy is £240, set aside £20 monthly. That simple tactic prevents forced borrowing when a large bill lands.

Cut or consolidate subscriptions

Unused streaming services, apps and memberships quietly drain accounts. Check recurring payments each month and cancel what you don’t use. Consider sharing family plans or rotating paid services to save money while keeping access.

Keep a realistic buffer, not a zero balance

Budgets that leave nothing for surprises fail quickly. Aim for a small emergency buffer—even £300 to £500 helps avoid using overdrafts or cards for minor unexpected costs. Treat the buffer like a fixed monthly category.

Don’t use credit for everyday gaps

Using credit cards or overdrafts for routine spending builds interest and stress. If you slip, focus first on a plan to reduce the balance: stop non-essentials, increase a small repayment each month, and move to a lower-rate option if needed. Seek free debt advice early rather than letting balances grow.

Review and adjust regularly

Set one hour each month to check spending, upcoming bills and goals. Make one small change after each review: cancel one subscription, increase savings by £10, or reallocate grocery spending. Small, consistent tweaks prevent leaks and make your budget sustainable.

Mistakes with mortgages and how to choose wisely

Many homebuyers make simple mortgage mistakes that cost thousands. Know the common traps and clear steps to choose a mortgage that fits your life and budget.

Not shopping around

Sticking with the first offer wastes money. Mortgage rates and fees vary by lender. Compare at least three lenders or use a broker to find a better rate. A 0.5% difference on a £200,000 loan can save hundreds each year.

Underestimating total costs

Don’t focus only on the interest rate. Look at arrangement fees, valuation fees, solicitor costs and stamp duty. Add these costs to your calculations so you know the real price of the mortgage.

Borrowing too much

Higher loan limits might seem tempting, but they raise monthly payments and risk if income falls. Aim for a comfortable monthly payment, not the maximum a lender offers. Stress-test your budget with lower income or higher rates to see if you can cope.

Ignoring the deposit and loan-to-value (LTV)

A larger deposit usually lowers your rate. If you can increase your deposit from 5% to 15%, you may access cheaper deals. Plan how much you can save and watch the LTV band your mortgage sits in.

Overlooking fixed vs variable choices

Fixed rates give certainty for a set term; variable (tracker) rates can fall or rise. If you prefer stable payments, a fixed deal is safer. If you expect rates to drop or move home soon, a variable deal might suit. Check early repayment charges before committing.

Not checking future flexibility

Life changes: job moves, children, or interest hikes. Look for flexible features like overpayment options, payment holidays or portability when you switch homes. Read the small print on fees for overpayments or switching lenders.

Skipping professional advice and support

A regulated mortgage adviser can spot costs and help you access exclusive deals. Check qualifications and ask about fees. Also, get a mortgage in principle before you bid on a property so you know your budget and look stronger to sellers.

Practical checklist

- Compare multiple lenders and deals.

- Include all fees in your calculations.

- Set a safe monthly payment, not the max.

- Increase your deposit if possible.

- Choose fixed or variable based on personal risk.

- Check overpayment and exit fees.

- Use a regulated adviser for complex cases.

Overlooking pension contributions and long-term planning

Ignoring your pension now can make retirement harder. Small changes today often lead to much bigger savings later.

Understand employer contributions and auto-enrolment

Most workers in the UK are automatically enrolled into a workplace pension. Employers must contribute at least a minimum amount, and your pay also adds to the pot. Check your payslip to see the contribution split and aim to get the full employer match.

Use tax relief to boost savings

Contributions usually receive tax relief, which means more goes into your pension than you pay out. Basic-rate relief is typically handled automatically. If you pay higher-rate tax, you may need to claim extra relief through self-assessment or your pension provider.

Start early and let compound interest help

Saving sooner gives your money more time to grow. Even modest monthly contributions add up over decades. Small regular amounts often beat late lump sums because compound interest multiplies returns over time.

Check and consolidate pension pots carefully

Changing jobs can leave multiple small pots across providers. Combining pots can simplify tracking and reduce fees, but watch for exit penalties or losing guaranteed benefits. Always check costs and look for cheaper, well-rated providers.

Know your state pension and personal goals

Check your State Pension forecast and decide what lifestyle you want in retirement. Use that target to set a monthly savings goal. If you need help, free guidance services can explain options for defined contribution pensions.

Practical monthly and yearly checks

Make short, regular checks to keep on track:

- Look at your latest pension statement once a year.

- Increase contributions when you get a pay rise or bonus.

- Claim any unpaid tax relief as soon as possible.

- Ask your employer about matching or flexible contribution options.

- Get independent advice before transferring complex or final-salary pensions.

Credit card pitfalls and practical debt management

Credit cards are convenient but can quickly lead to costly debt if misused. Small mistakes grow fast without a clear plan.

High interest and minimum payments

Paying only the minimum keeps you in debt longer and increases interest charges. Always pay more than the minimum when you can to reduce the balance and save on interest.

Late payments and extra fees

Missing a payment often causes late fees and a higher rate. Set up direct debit or calendar reminders to avoid penalties and protect your credit score.

Balance transfers and introductory offers

0% deals can help, but watch the fee and the length of the offer. If you don’t clear the balance before the rate ends, interest can be charged on the full amount.

Multiple cards and credit score impact

Having several cards may increase your available credit but can harm your score if you miss payments. Keep accounts active and manageable, and close only if you’re sure it won’t raise your credit utilisation too much.

Ignoring interest-free periods

Using a card for purchases without paying the balance off before the interest-free period ends defeats the purpose. Track purchase dates and plan repayments to keep interest at bay.

Practical debt management steps

- List all cards, balances, rates and minimum payments.

- Prioritise high-rate balances for faster repayment.

- Consider a single low-rate consolidation or a balance transfer with no hidden fees.

- Create a clear repayment plan with set monthly targets.

- Seek free debt advice early if you struggle; it can prevent worse outcomes.

Small, steady actions—like paying a bit extra each month and stopping non-essential spending—cut interest costs and clear debt sooner.

Neglecting insurance and emergency fund basics

Unexpected costs like a broken boiler, a short income spell, or a small home repair can quickly become a crisis without basic insurance and an emergency fund. Treat both as pillars of a stable plan.

Types of essential insurance

Start with core covers: home or contents insurance, motor insurance if you drive, and income protection or critical illness cover if you rely on your salary. For renters, contents insurance protects belongings; for homeowners, building cover is crucial. Check the excess, exclusions and whether policies cover temporary accommodation or replacement costs.

How to build a usable emergency fund

Aim for three to six months of essential expenses over time. If that feels large, start with a small target—£500 to £1,000—as a usable buffer. Save a fixed amount each payday into a separate, easily accessible account so you don’t touch it for routine spending.

When to use insurance and when to use savings

Use savings for small, predictable shocks (a broken phone, minor repairs). Use insurance for large, infrequent events—major home damage, long-term illness or total loss. Don’t rely on credit for emergencies; interest makes problems worse.

Ways to reduce costs without losing cover

Compare quotes annually and increase your voluntary excess to lower premiums if you can afford it. Ask about multi-policy discounts and loyalty offers, but compare the total cost. Bundle where sensible, and remove unneeded extras that add little value.

Simple checks to stay protected

- Review policies yearly to match your current home, car and family situation.

- Keep a short list of policy names, emergency contact numbers and renewal dates.

- Top up your emergency fund after using it and after pay rises.

- Consider separate savings for planned large expenses so your emergency fund stays untouched.

- Seek impartial advice if you have a complex situation, like a final-salary pension or high-value home.

Small, steady steps—building a modest buffer and keeping basic insurance active—prevent stress and costly debt when life throws a curveball.

Tax oversights and simple steps to reduce liability

Missing small tax details can lead to bigger bills or penalties. Common oversights include wrong tax codes, unclaimed reliefs, late self-assessment and forgetting allowable expenses.

Check your tax code and payslips

Verify your tax code on each payslip and your employer’s documents. A wrong code can mean underpaid tax. If you spot an error, contact HMRC or your payroll department quickly to correct it.

Keep clear records of income and expenses

Save receipts, invoices and bank statements. Good records make claims easier and prove expenses if HMRC asks. Self-employed people and landlords should record income consistently and keep documents for at least six years.

Use allowances and tax-efficient accounts

Make the most of ISAs and pension contributions to reduce taxable income. Pension contributions often attract tax relief, and ISAs grow tax-free. Regular, small contributions usually beat late lump sums.

Claim reliefs you may overlook

Check for common reliefs like the marriage allowance, Gift Aid on donations, and work-related expenses allowed by HMRC. These can reduce your liability without complex steps.

Meet key deadlines to avoid penalties

Note self-assessment deadlines and pay on time. Filing or paying late can trigger fines and interest. Set calendar reminders for filing and payment dates to stay ahead.

When to get help and simple safeguards

If your tax situation is complex, get professional advice. For smaller queries, HMRC guidance and online tools can help. Act early if you think you owe tax—arranging a payment plan is better than waiting for penalties.

- Check tax codes each payday.

- Log income and expenses monthly.

- Use ISAs and pension contributions for tax efficiency.

- Claim available reliefs like marriage allowance and Gift Aid.

- Mark filing and payment deadlines in your calendar.

- Ask for help before problems grow.

Take simple steps to protect your money

Small changes make a big difference. Track spending, build an emergency fund and check your insurance. Review mortgage options, pension contributions and how you use credit.

Do a short monthly check: log expenses, adjust savings, cancel unused subscriptions and compare deals. Use ISAs and pensions to reduce tax where you can.

If you feel unsure, get free or regulated advice. Start with one action this week—log your spending or set up a small standing transfer to savings. Consistent steps protect your future.